Overview

Social Security benefits for retirees are paid out from a trust fund called the Old-Age and Survivors Insurance (OASI) Trust Fund. The U.S. didn't begin taxing distributions from the 50 year-old program until 1984 when Reagan passed the Social Security Amendments which were signed into law to keep the program solvent. The revenue from these taxes goes right back into the trust fund. We face a similar challenge today, with the Congressional Budget Office projecting the fund will be depleted at the end of fiscal year 2033. At that point, beneficiaries would face a 25% reduction in benefits unless Congress acts to address the shortfall.

A recent policy proposal has been to end taxation of Social Security benefits. It is always politically attractive to give tax breaks to large chunks of the voter base. However, with the current debt and deficit situation it doesn't seem wise to add another $100 billion to the nation's yearly nut. Is there another way to get a political win without bankrupting the country?

One Solution

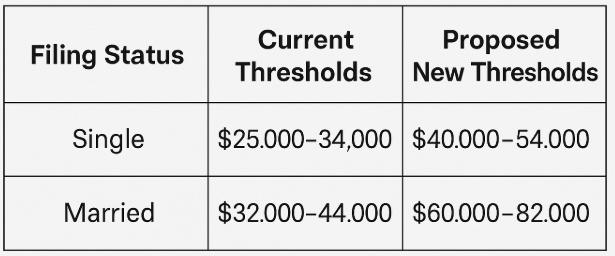

Benefits are taxed based on combined income (adjusted gross income + nontaxable interest + half of Social Security benefits). If combined income exceeds certain thresholds ($25,000 individual/$32,000 joint filers), up to 50% of benefits may be taxable; above higher thresholds ($34,000 individual/$44,000 joint), up to 85% of benefits become taxable. Below these limits, benefits are tax-free. These thresholds have not been changed since 1993 when the maximum taxable portion was increased to 85%.

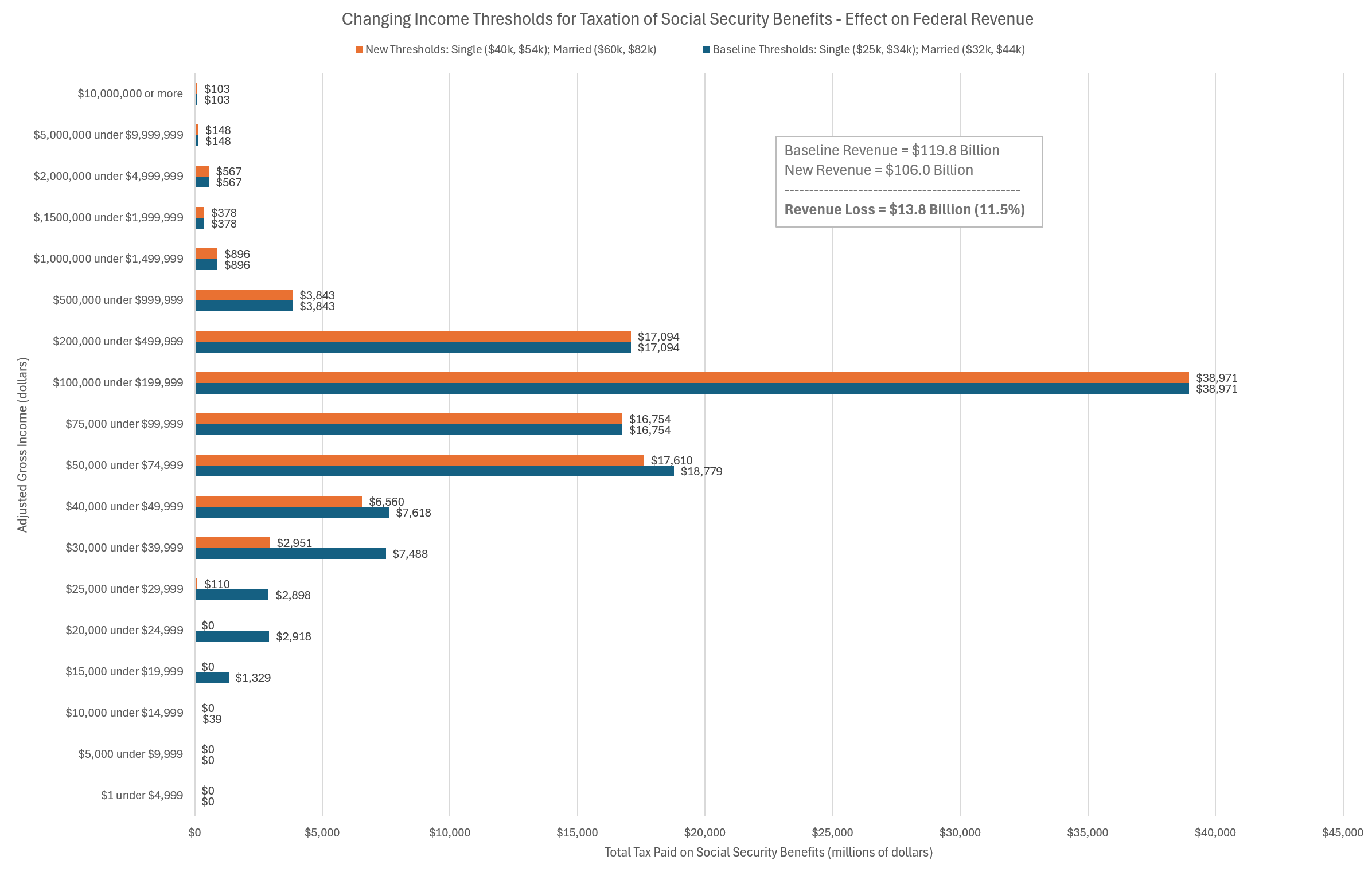

I can't take credit for this idea, but I did help quantify the effect. That idea is to raise the income threshold for taxation of benefits. It's a progressive policy in the technical sense, meaning it benefits the poor more than the rich. It sounds great to voters. And it gives the administration a win on this issue.

What is the hit to the trust fund? After some number crunching using the stuff we set up in my previous post we found this:

An 11.5% reduction in revenue from benefits, and it all goes back to beneficiaries with AGI's in the 5-figures.